(Markets in Crypto-Assets – MiCA) was published on June 9, 2023. It provides specific rules and requirements for crypto-assets, related services and activities that were previously not covered by Union legislative acts on financial services.

MiCA was first announced in the on September 24, 2020 which provided an EU . The European Council subsequently reached a on MiCA on June 30, 2022. On May 16, 2023, the European Council formally MiCA.

With the publication of MiCA in the Official Journal of the European Union, the regulation entered into force on June 29, 2023. The regulation became fully applicable as of December 30, 2024, and member states were required to adopt and publish by that date the necessary provisions to comply with the amendments to (Capital Requirements Directive – CRD) and (Whistleblowing Directive).

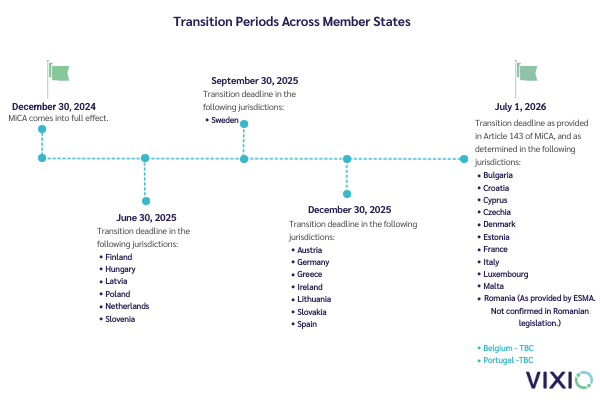

The MiCA regulation provided for a grandfathering provision whereby crypto-asset service providers (CASPs) which provided their service in accordance with the applicable national law before December 30, 2024 could continue their services until July 1, 2026. However, member states were permitted to choose an earlier date, and had until June 30, 2024 to inform the European Commission of their derogation.

MiCA also contained various empowerments for the European Banking Authority (EBA) and European Securities and Markets Authority (ESMA) to draft regulatory technical standards (RTS) and implementing technical standards (ITS). These draft technical standards, once finalised by the regulators, are submitted to the European Commission for endorsement. If endorsed, these standards are published in the Official Journal of the European Union as either a Commission Delegated Regulation (for RTS) or a Commission Implementing Regulation (for ITS). The procedure for the adoption of delegated acts is known as ().

To date, the European Commission has published 34 delegated and implementing regulations, and a total of 9 RTS and ITS are currently awaiting European Commission endorsement.

RTS are a set of rules which aim to supplement or further specify the act. An example of this is , which further specifies Article 17(1) of MiCA relating to the procedure for the approval of crypto-asset white papers. Meanwhile, ITS aim to ensure uniform conditions for implementing EU acts. This is exemplified by , which provides the forms, formats and templates for crypto-asset white papers.

MiCA likewise mandated ESMA, in close corporation with the EBA, to issue guidelines on several MiCA topics, including guidelines to assist competent authorities in their supervisory tasks.

This Mapping EU Legislation: MiCA page will be updated in line with any MiCA update. This includes any RTS, ITS, delegated regulation, implementing regulation or guideline issued and published.

|

Item |

Date |

|

MiCA application date |

December 30, 2024 |

|

Member states to adopt and publish necessary provisions |

December 30, 2024 |

|

CASP transition period provided by the EU |

July 1, 2026 |

|

Member state notification of a change to the transition period |

June 30, 2024 |

|

Issuers of asset-referenced tokens transition period |

Authorisation applied for by July 30, 2024 |

|

Credit institutions issuing asset-referenced tokens |

Notification by July 30, 2024. |

Transition Periods

determined that crypto-asset service providers that provided their services in accordance with applicable law before December 30, 2024 may continue to do so until July 1, 2026 or until they are granted or refused an authorisation pursuant to Article 63, whichever is sooner. However, according to Article 143(3), member states could determine a shorter transition period. The following periods are provided by the .

For a larger version of the timeline, click .

|

Country |

Transposition Deadline |

|

6 months, June 30, 2025 |

|

|

6 months, June 30, 2025 |

|

|

6 months, June 30, 2025 |

|

|

6 months, June 30, 2025 |

|

|

6 months, June 30, 2025 |

|

|

6 months, June 30, 2025 |

|

|

9 months, September 30, 2025 |

|

|

12 months, December 30, 2025 |

|

|

12 months, December 30, 2025 |

|

|

12 months, December 30, 2025 |

|

|

12 months, December 30, 2025 |

|

|

12 months, December 30, 2025 (originally 6 months but was extended) |

|

|

12 months, December 30, 2025 |

|

|

12 months, December 30, 2025 |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 |

|

|

18 Months, July 1, 2026 To be able to benefit from the grandfathering period, applicant CASPs must apply before July 31, 2025. |

|

|

18 Months, July 1, 2026 To be able to benefit from the grandfathering period, applicant CASPs must apply before December 30, 2024. |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 (originally 12 months but was extended) Entities registered as virtual asset service providers in the Italian anti-money laundering and countering the financing of terrorism register, or entities belonging to the same group, must file their application for MiCA authorisation by December 30, 2025 to benefit from the grandfathering period. |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 |

|

|

18 months, July 1, 2026 (ESMA has provided this date. Romanian legislation, however, does not stipulate an exact transition period.) |

|

|

Belgium |

To be announced. |

|

To be announced. |

MiCA Secondary Regulations

|

Regulation |

Notes |

|

Provides ITS for the forms, formats and templates for crypto-asset white papers. |

|

|

Provides RTS specifying the procedure for the approval of a crypto-asset white paper. |

|

|

Provides RTS for estimating the number and value of transactions associated with the use of asset-referenced and e-money tokens as a means of exchange. |

|

|

Provides ITS for reporting related to asset-referenced tokens and to e-money tokens denominated in a currency that is not an official currency of a member state. |

|

|

Provides RTS for the complaints-handling procedures of asset-referenced token issuers. |

|

|

Provides RTS for specifying certain criteria for classifying asset-referenced tokens and e-money tokens as significant. |

|

|

Provides RTS specifying the information that certain financial entities must include when notifying their intention to provide crypto-asset services. |

|

|

Provides RTS specifying the information to be included in an application for authorisation as a crypto-asset service provider. |

|

|

Provides RTS on business continuity and regularity for crypto-asset service providers. |

|

|

Provides RTS specifying the requirements, templates and procedures for the handling of complaints by the crypto-asset service providers. |

|

|

Provides RTS specifying the manner in which crypto-asset service providers operating a trading platform for crypto-assets are to present transparency data. |

|

|

Provides RTS specifying the content and format of order book records for crypto-asset service providers (CASPs) operating trading platforms for crypto-assets. |

|

|

Provides ITS with regard to the technical means for the appropriate public disclosure of inside information and for delaying the public disclosure of that information. |

|

|

Provides ITS with regard to standard forms, templates and procedures for the cooperation and exchange of information between competent authorities and EBA and ESMA. |

|

|

Provides RTS on information to be exchanged between competent authorities. |

|

|

Provides ITS with regard to standard forms, templates, and procedures for the cooperation and exchange of information between competent authorities. |

|

|

Provides RTS specifying the criteria and factors to be taken into account by ESMA, the EBA and competent authorities in relation to their intervention powers. |

|

|

Provides RTS establishing a template document for cooperation arrangements between competent authorities and supervisory authorities of third countries. |

|

|

Provides RTS specifying the conditions for the establishment and functioning of consultative supervisory colleges. |

|

|

Provides RTS specifying the procedural rules for the exercise of the power to impose fines or periodic penalty payments by the EBA on issuers of significant asset-referenced tokens and issuers of significant e-money tokens. |

|

|

Provides RTS specifying the fees charged by the EBA to issuers of significant asset-referenced tokens and issuers of significant e-money tokens. |

|

|

Provides ITS with regard to standard forms, templates and procedures for the notification by certain financial entities of their intention to provide crypto-asset services. |

|

|

Provides RTS specifying adjustment of own funds requirement and minimum features of stress testing programmes of issuers of asset-referenced tokens or of e-money tokens. |

|

|

Provides RTS specifying the minimum content of the governance arrangements on the remuneration policy of issuers of significant asset-referenced or e-money tokens. |

|

|

Provides RTS specifying the procedure and timeframe for an issuer of asset-referenced tokens or of e-money tokens to adjust the amount of its own funds. |

|

|

Provides RTS specifying the data necessary for the classification of crypto-asset white papers and the practical arrangements to ensure that such data is machine-readable. |

|

|

Provides ITS with regard to standard forms, templates and procedures for the information to be included in the application for authorisation as a crypto-asset service provider. |

|

|

Provides RTS specifying the detailed content of information necessary to carry out the assessment of a proposed acquisition of a qualifying holding in a crypto-asset service provider. |

|

|

Provides RTS specifying the detailed content of information necessary to carry out the assessment of a proposed acquisition of a qualifying holding in an issuer of an asset-referenced token. |

|

|

Provides RTS specifying the requirements for policies and procedures on conflicts of interest for crypto-asset service providers and the details and methodology for the content of disclosures on conflicts of interest. |

|

|

Provides RTS specifying the requirements for policies and procedures on conflicts of interest for issuers of asset-referenced tokens. |

|

|

Provides RTS specifying records to be kept of all crypto-asset services, activities, orders and transactions undertaken. |

|

|

Provides RTS specifying the content, methodologies and presentation of information in respect of sustainability indicators in relation to adverse impacts on the climate and other environment-related adverse impacts. |

|

|

Provides RTS specifying the arrangements, systems and procedures to prevent, detect and report market abuse, the templates to be used for reporting suspected market abuse, and the coordination procedures between the competent authorities for the detection and sanctioning of market abuse in cross-border market abuse situations. |

|

| (ÂÜŔňžž update) |

Provides RTS specifying the information in an application for authorisation to offer asset-referenced tokens to the public or to seek their admission to trading. |

| (ÂÜŔňžž update) |

Provides ITS regarding the establishment of standard forms, templates and procedures for the information to be included in the application for authorisation to offer asset-referenced tokens to the public and to seek their admission to trading. |

MiCA Secondary Regulations Awaiting European Commission Adoption

|

Technical Standards |

Notes |

|

Develops the capital treatment for credit risk, counterparty credit risk and market risk by providing that all fair-valued crypto-assets within the scope of MiCA shall be subject to the requirements for prudent valuation under CRR 3. |

|

|

Specifies the highly liquid financial instruments with minimal market risk, credit risk and concentration risk under Article 38(5) of MiCA. |

|

|

Further specifies the liquidity requirements of the reserve of assets under Article 36(4) of MiCA. |

|

|

Specifies the minimum contents of the liquidity management policy and procedures under Article 45(7)(b) of MiCA. |

|

|

Specifies the minimum content of the governance arrangements on the remuneration policy under Article 45 of MiCA. |

|

|

Aim to harmonise the different steps and timeframes of the approval procedure, to ensure clear expectations and transparency for credit institutions seeking to issue ARTs. |

MiCA Guidelines

|

Guideline |

Notes |

|

The guidelines propose a standardised test, as well as templates for explanations and legal opinions that provide descriptions of the regulatory classification of crypto-assets. |

|

|

The guidelines on templates to assist competent authorities in performing their supervisory duties regarding issuers’ compliance with MiCA, aiming to ensure that competent authorities have sufficient comparable information to supervise compliance of issuers, and to provide the EBA with the information necessary to conduct the significance assessment. |

|

|

The guidelines on redemption plans under MiCA specify the content of the redemption plan, the timeframe for review and the triggers for its implementation. |

|

|

The guidelines on liquidity stress testing, lay out the risks identified by the EBA to be covered in the liquidity stress testing. They also pinpoint the methodology identifying the common reference parameters of the stress test scenarios to be included in the liquidity stress testing to be applied. |

|

|

The guidelines on recovery plans under MiCA set out the requirements with respect to the format of the recovery plans and the information to be included therein. |

|

|

The guidelines on internal governance arrangements for issuers of ARTs specify the governance provisions that these issuers should comply with, taking into account the proportionality principle. |

|

|

The guidelines on the suitability assessment of shareholders or members, whether direct or indirect, with qualifying holdings in issuers of ARTs and CASPs provide competent authorities common methodology to assess the suitability of the shareholders and members with direct or indirect qualifying holdings for purposes of granting authorisation as issuers of ARTs or as CASPs, and for carrying out the prudential assessment of proposed acquisitions. |

|

|

The guidelines on the suitability assessment of the members of the management body of issuers of ARTs and CASPs provide common criteria to assess the appropriate knowledge, skills and experience of members of the management body as well as their good repute, honesty and integrity and if they are able to commit sufficient time to perform their duties. |

|

|

The guidelines specify conditions for classification under Article 2(4)(a) of MiCA and set a uniform regulatory approach across the EU. |

|

|

The guidelines are based on Article 14(1)(d) of MiCA, requiring the relevant entities to maintain their systems and security access protocols in accordance with the appropriate Union standards. They set appropriate Union standards for offerors and those seeking admission to trading, focusing on maintaining systems, security access protocols, policies and procedures. |

|

|

The guidelines are based on Article 61(3) of MiCA, requiring competent authorities and third-country firms to ensure compliance with the reverse solicitation exemption. They establish supervisory practices to detect and prevent firms from improperly engaging with EU clients, focusing on digital marketing, third-party intermediaries and indirect promotional strategies. |

|

|

The guidelines aim to establish common, uniform and consistent application of MiCA’s provisions on certain aspects of the suitability requirements and formats of the periodic statement for portfolio management activities. |

|

|

The guidelines aim to provide greater clarity on the requirements for crypto-asset service providers offering transfer services on behalf of clients. They outline the necessary procedures and policies, including client rights, in the context of crypto-asset transfers. |

|

|

The guidelines set out general principles to ensure high-quality and effective supervision of market abuse in crypto-assets. They also outline more specific practices for national competent authorities (NCAs), with all principles being risk-based. |

.svg)